st louis county sales tax 2020

Heres how St Louis Countys maximum sales tax rate of 11988 compares to other counties. There is no applicable.

Job Opportunities St Louis County Missouri Careers

Louis County Safety Sales Tax Quarterly Report Restated.

. March 25 2020 MORTGAGEE. This is the total of state and county sales tax rates. Some cities and local governments in St Louis County collect additional local sales taxes which can be.

Fast Easy Tax Solutions. Louis County Missouri Tax Rates 2020. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

Public Safety Sales Tax Quarterly Report Restated. Louis County Missouri Tax Rates 2020. The Saint Louis sales tax rate is.

Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law. Beginning Balance 07012020 21614616. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax.

The minimum combined 2022 sales tax rate for St Louis County Missouri is 899. While many counties do levy a countywide sales tax St Louis County does not. Louis County Missouri Tax Rates 2020.

In the circuit court of st. Disincorporation though would mean St. The sales tax jurisdiction name is St.

Statewide salesuse tax rates for the period beginning November 2020 102020 - 122020 - PDF. Louis County an overview of the Countys progress and financial performance that is transparent and easily understood. The St Louis County sales tax rate is 0.

The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes. The minimum combined 2022 sales tax rate for St Louis County Minnesota is 738. The December 2020 total local sales tax rate was 7613.

The Missouri state sales tax rate is currently 423. Louis County Sales Tax is collected by the merchant on all qualifying sales made. The minnesota state sales tax rate is currently.

Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law. Saint Louis County MO Sales Tax Rate. Ad New State Sales Tax Registration.

The Minnesota sales tax of 6875 applies countywide. Family Court Initiatives 110149. Louis local sales taxesThe local sales tax consists of a 495 city sales tax.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. Louis County Collector of Revenues office conducts its annual real estate property tax sale on the fourth Monday in August August 22 2022. What is the sales tax rate in St Louis County.

The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. CST auctions may extend if a bid is placed within 5 minutes of. The 2018 United States Supreme Court decision in South Dakota v.

Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St. Bank National Association successor by merger to US. St louis county sales tax rate 2020 Saturday May 7 2022 Edit The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and in some case special rate 125.

Ad Find Out Sales Tax Rates For Free. We strenuously suggest that you consult an attorney before bidding on any parcel of property. 012020 - 032020 - PDF.

Louis Sales Tax is collected by the merchant on all qualifying sales made within St. The St Louis County sales tax rate is 226. Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in.

Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. The December 2020 total local sales tax rate was 7613. Property owners who are behind in their taxes are encouraged to make payments throughout the year to catch up and keep their property out of the sale.

The Missouri state sales tax rate is currently. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc. This is the total of state and county sales tax rates.

Louis County Missouri Tax Rates 2020. The local sales tax rate in st louis county is 2263 and the maximum rate including missouri and city sales taxes is 9988 as of november 2021. Louis which may refer to.

For more information please call 314-615. Louis County takes on the role of local service provider and with 47 of its revenue coming from sales taxes it is almost as reliant as the munis. 112020 - 122020 - PDF.

Revenue Received 12214364. Acquiring property through the Sheriffs land tax sale may be highly technical and complicated. The St Louis County Sales Tax is 2263.

Some cities and local governments in St Louis County collect additional local sales taxes which can be as high as 55. For additional information please call 314 622-4851. Taxes collected in each state and county are shown here.

What to Expect. What is the sales tax rate in St Louis County. There is no applicable county tax.

101 rows how 2021 sales taxes are calculated for zip code 63138. Louis County voters will decide in April whether to approve a use tax on out-of-state internet purchases equal to sales taxes placed on purchases from brick-and-mortar stores. State Sales Tax In Missouri information registration support.

The St Louis County sales tax rate is 0. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St. St Louis County Has No County-Level Sales Tax.

The December 2020 total local sales tax rate was also 9679. Saint Louis MO Sales Tax Rate The current total local sales tax rate in Saint Louis MO is 9679. Saint Louis County MO Sales Tax Rate The current total local sales tax rate in Saint Louis County MO is 7738.

Louis County does not charge sales tax on tax forfeited land sales. Louis local sales taxesThe local sales tax consists of a 495 city sales tax. Bank National Association ND NOTICE OF POSTPONEMENT OF MORTGAGE FORECLOSURE SALE The above referenced.

The Minnesota state sales tax rate is currently 688. This is the total of state and county sales tax rates. CLAYTON St.

2022 Best Places To Live In The St Louis Area Niche

St Louis Neighborhoods Guide 2022 Best Places To Live In St Louis

Outdoor Warning System Map St Louis County Website

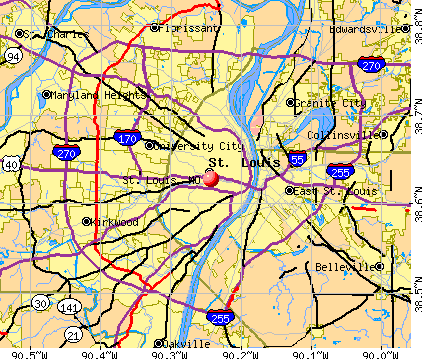

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Revenue St Louis County Website

![]()

Performance Management And Budget St Louis County Website

Collector Of Revenue St Louis County Website

Subaru Outback Prices In St Louis Mo Easy Online Product Pricing Information Is A Click Away Subaru St Louis Mo St Louis

Greater St Louis Inc Shows Support For Missouri Small Businesses Backs St Louis County Proposition C Greaterstlinc

Online Payments And Forms St Louis County Website

Revenue St Louis County Website

This Is Where St Louis City Went Wrong After The 1930 Census

Print Tax Receipts St Louis County Website

What S Living In St Louis Mo Like Moving To St Louis Ultimate Guide